2013 CHECK POINT ANNUAL SECURITY REPORT

04

_ DATA LOSS INCIDENTS IN YOUR NETWORK

032

(see list of data types in Appendix D) which were sent

to external destinations either by email or other online

posting means.

Our findings, as depicted on Chart 4-A, indicate that

Government and Financial organizations were at the

highest risk of potential data loss.

Internal Emails Sent Outside of the

Organization

In many cases, data loss events occur unintentionally

through employees sending email communications to

the wrong recipients. Our research looked at two types

of emails that may indicate such incidents. The first type

consisted of emails that were sent with internal visible

recipients (i.e. To and CC) and external recipients in

the BCC field. Such emails, in most cases, seemed to be

internal but actually left the company. The second type

consisted of emails sent to several internal recipients

and a single external party. Such emails were usually sent

unintentionally to a wrong external recipient. One or both

of these types of events were found in 28% of organizations

examined.

What Types of Data Do Employees Send to

External Recipients or Post Online?

Chart 4-C shows the top data types sent to parties outside

of the organization. Credit card information led the list,

while source code and password protected files registered

second and third respectively.

Is your Organization PCI Compliant?

Staff members routinely send credit card numbers over

the Internet - their own and their customers’. Employees

send customer payment receipts that contain credit card

information in email attachments. They reply to customer

emails that contain credit card information in the original

email body text. At times, employees even send spreadsheets

with customer data to private email accounts or to email

addresses of business partners. Often, credit card number-

related incidents resulted due to broken business processes

or employees’ lack of attention and awareness. Such incidents

may indicate that the corporate security policy does not

meet the objective of promoting secure and careful use of

corporate property.

Moreover, sending credit card numbers over the Internet

is not compliant with PCI DSS requirement 4, which

mandates that cardholder data must be encrypted during

transmission across open public networks. Failing to

comply with PCI DSS can result in a damaged corporate

reputation, lawsuits, insurance claims, cancelled accounts,

payment card issues, and government fines.

Our research inspected outgoing traffic from organizations

and scanned the content of all message parts, including

attachments and archives. We also searched for emails

containing credit card numbers or cardholder data. The

inspections were based on regular expressions, validation of

check digits, and PCI DSS compliance regulations.

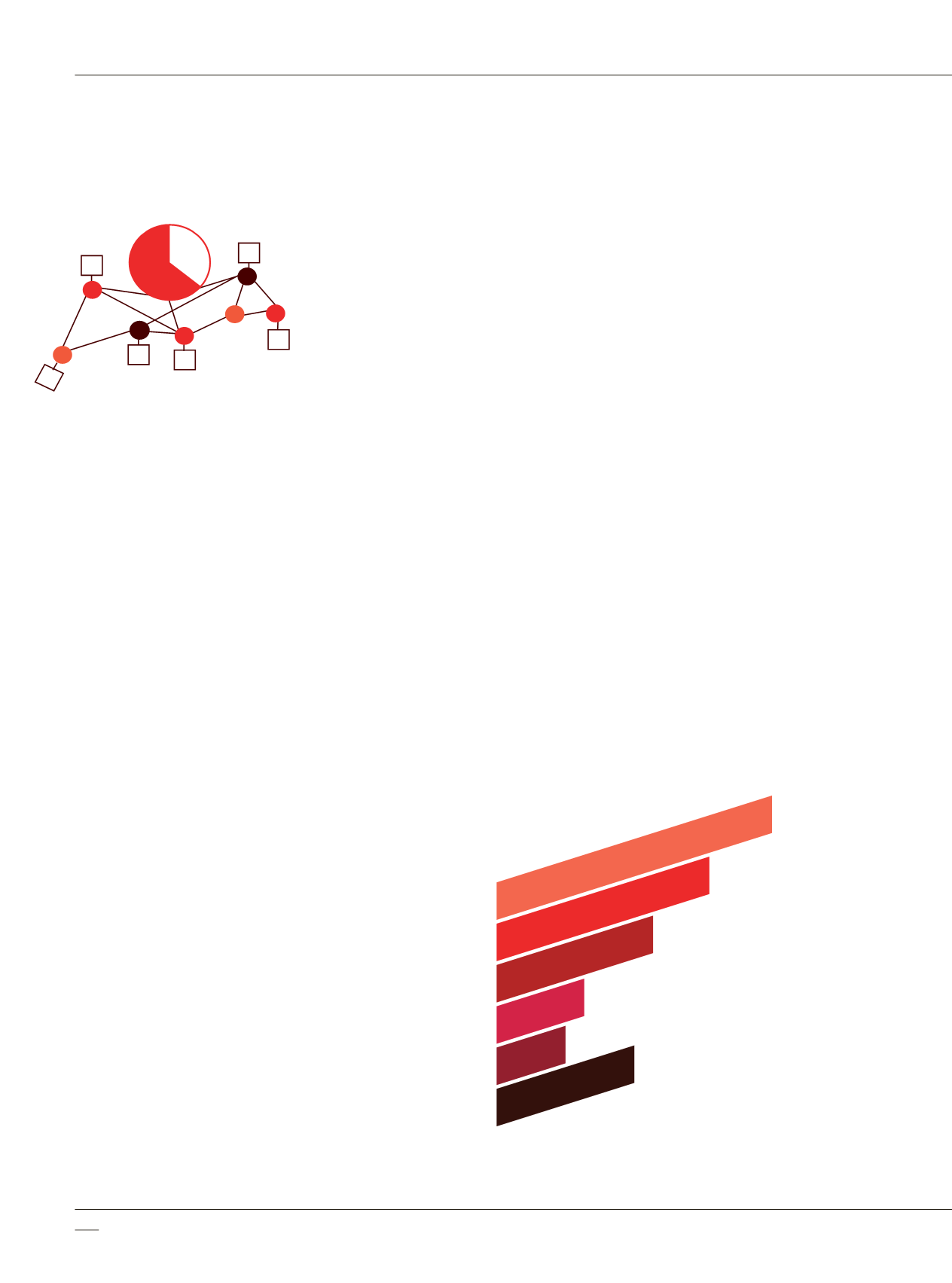

36

%

Finance

26

%

Industrial

18

%

Telco

11

%

Consulting

26

%

Other

47

%

Government

Percentage of Organizations by Industry

in which Credit Card Information was

Sent Externally

(% of Organizations)

In 28% of TEST Organizations

an Internal Email

was Found to be Sent

to an External

Recipient

Chart 4-B

Source: Check Point Software Technologies